Starting December 1, 2024, customers facing difficulties withdrawing cash from banks are encouraged to report such issues directly to the Central Bank of Nigeria (CBN) through dedicated communication channels.

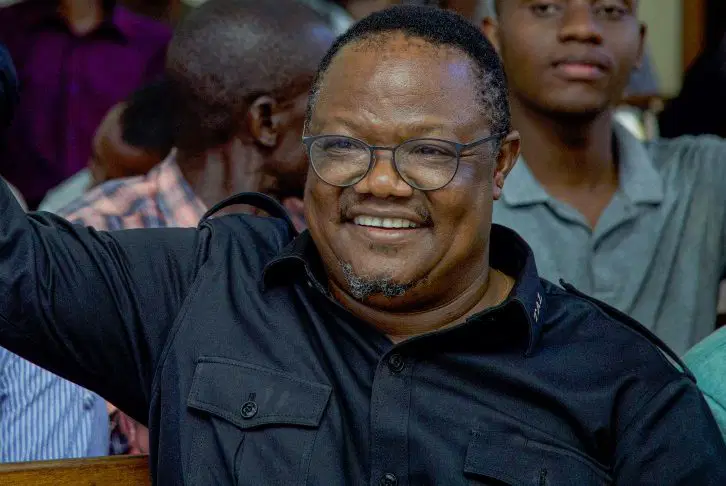

- This announcement was made by the CBN Governor, Olayemi Cardoso, during the 2024 Bankers’ Night organized by the Chartered Institute of Bankers of Nigeria (CIBN) in Lagos on Friday.

- Speaking at the event, Cardoso emphasised the CBN’s commitment to addressing operational inefficiencies in the banking sector.

- “We understand the frustrations customers face when accessing their funds, and this initiative is part of our broader effort to ensure accountability and improve the quality of services offered by financial institutions,” he stated.

- Looking ahead to 2025, Cardoso outlined the CBN’s strategic priorities, highlighting advancements in technology and regulatory frameworks.

- “In the coming year, we will focus on key initiatives such as implementing our Open Banking Framework, advancing contactless payment systems, and expanding our regulatory sandboxes,” he said.

- The governor also revealed plans to release revised guidelines for agency banking, aiming to enhance its role in promoting financial inclusion, particularly in underserved communities. Cardoso noted, “We are not only working to modernize Nigeria’s payment infrastructure but also to ensure that every Nigerian, regardless of their location, can access financial services.”