Nigeria’s major oil marketers listed on the Nigerian Exchange (NGX) successfully navigated rising operational expenses, achieving more than 100 percent year-on-year growth in their nine months’ net profits, thanks to subsidy removal.

- The partial and full subsidy removal from May 2023 jacked up petrol prices, resulting in more revenues and profits for major oil marketers.

- The petrol price has hovered from 200/litre since late May 2023 to over 1000/litre in November 2024.

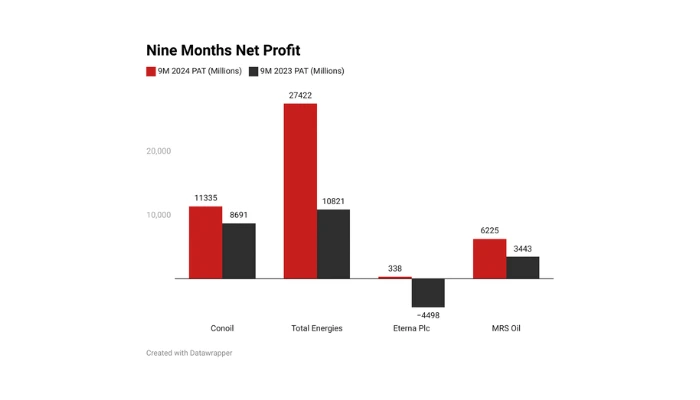

- The downstream oil companies listed on the NGX are TotalEnergies Marketing Nigeria, MRS Oil Nigeria, Eterna Plc, and Conoil Plc. In the nine months ending September 30, 2024, the four companies posted a cumulative profit after tax of N45.3 billion, representing a significant 146 percent year-on-year growth from the N18.5 billion posted in the corresponding period of 2023.

- TotalEnergies Marketing Nigeria posted the highest profit generated by any oil marketer during the nine-month period, with a N27.4 billion net profit, representing a 153 percent year-on-year growth from the N10.8 billion net profit recorded in 9M 2023.

- The company also recorded the highest revenue of any downstream oil company during the period, generating N793.9 billion in revenue.

- Total’s revenue was 88 percent year-on-year higher than the N422.6 billion revenue generated in 9M 2023.

- Following TotalEnergies, Conoil posted a net profit of N11.3 billion during 9M 2024, representing a 30 percent year-on-year growth from the N8.7 billion net profit posted in 9M 2023. Conoil recorded revenue of N249.1 billion during the period, which was 81 percent higher than the N137.9 billion revenue recorded in the corresponding period in 2023.

- MRS Oil posted an N248.7 billion revenue during the nine months, representing a 147 percent year-on-year growth from the N100.9 billion revenue posted in 9M 2023. With a gross profit of N18.8 billion, MRS recorded a net profit of N6.2 billion, which represented an 81 percent year-on-year growth from the N3.4 billion net profit posted in 9M 2023.

- Eterna also bounced to profitability, with a net profit of N338 million recorded in the nine months of 2024, representing a 108 percent year-on-year growth from the N4.5 billion net loss posted in 9M 2023. The company’s revenue during the period was N233.8 billion, reflecting a 90 percent year-on-year increase from the N123.3 billion revenue posted in the corresponding period in 2023.

- For MRS, most of its operational costs were driven by administrative expenses, which appreciated by 83 percent year-on-year to N6.4 billion, up from N3.5 billion recorded in 9M 2023. Additionally, selling and distribution expenses increased 43 percent year-on-year to N796 million, from N538 million in 9M 2023.

- MRS also faced soaring petrol prices, with administrative petrol costs for office use reaching N829.8 million, marking a 126 percent year-on-year increase from N367.8 million recorded last year.- TotalEnergies’ operational costs were similarly impacted, with administrative expenses rising by 55 percent year-on-year to N45.3 billion for 9M 2024, up from N29.2 billion in 9M 2023.

The company also experienced a significant increase in transportation costs, which appreciated by 189 percent year-on-year to N11.5 billion, from N4 billion in the corresponding period in 2023.- Notably, TotalEnergies incurred a N6.6 billion consultancy expense during the period, reflecting a 293 percent year-on-year growth from N1.7 billion spent on a similar item in the same period of 2023.

- Eterna’s operational costs were also driven by administrative expenses, with the group incurring N6.4 billion in this category, while its selling and distribution expenses stood at N285.6 million.

During the nine-month review period, the four major oil companies reported a cumulative increase in their inventories as they sought to bolster their stock of petroleum products. Collectively, these companies expended N78.6 billion on inventory enhancement, with TotalEnergies leading the way.

TotalEnergies allocated N67.7 billion towards increasing its inventory, which rose to N141.2 billion, up from N73.9 billion at the beginning of the year. In contrast, Eterna sold off approximately N5.3 billion worth of its inventories, while Conoil invested N14.5 billion to strengthen its inventory.In addition to fuel sales, these companies are also involved in lubricant production; however, over 90 percent of their revenue is still derived from fuel sales.The landscape may shift with the recent launch of PMS production at the Dangote refinery in October, alongside indications that NNPCL’s role as Nigeria’s sole petrol importer may be coming to an end.

The potential impact of direct petrol sourcing on the financial performance of these companies remains to be observed.Currently, Conoil Plc, TotalEnergies Marketing Nigeria, and MRS Oil are members of the Major Oil Marketers Association of Nigeria (MOMAN), while Eterna Plc is affiliated with the Depot and Petroleum Product Marketers Association of Nigeria.